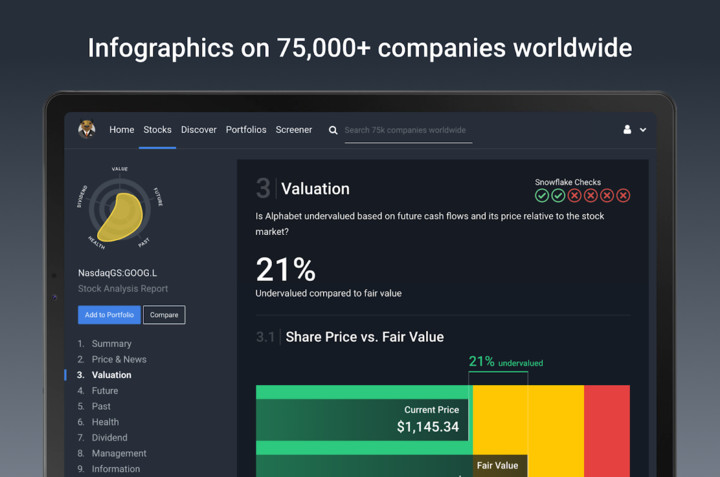

Discover new long-term investment opportunities with Simply Wall St. Swipe through the market and add stocks you like to your Portfolio. Detailed fundamental analysis on over 72,000 listed companies presented as an easy to understand infographic. Covering 27 markets including North America, Europe, Asia and Oceania. 📰 Featured in: Techcrunch, CNBC, Forbes, Sky News, TechCrunch and Financial Review The Simply Wall Street app is a free, simplified version of the Simply Wall St web platform used by more than 1,000,000 investors. To help you find good long-term investments we provide you with a detailed fundamental analysis on every listed company presented as an easy to understand infographic. ► Select what kind of stocks you are interested in, such as: ▷ Undervalued ▷ High Growth ▷ Bank account beaters ▷ Top dividend payers ► Swipe through the results to find companies that interest you and add them to your Portfolio ► Dive in deeper and conduct detailed due diligence on any company in the US, Canada, UK, Australia or New Zealand using our infographic report ► We analyse and visualize your Portfolio to help you understand where the strengths and weaknesses are ► Link your Portfolio to popular brokers such as E*Trade, Fidelity, Scottrade and Vanguard 🎓 Used by students at: MIT, Stanford, Princeton, Harvard, NYU Stern, Berkeley The analysis uses institutional quality data from Standard and Poor’s Capital IQ and performs 30 checks across 5 different areas. Over 1,000 data points are used to analyse each company and these are updated every 6 hours. Each company also has a Snowflake graph which is a summary of the infographic and gives you a quick snapshot of company’s investment profile. ► Value Discounted Cash Flow calculation (DCF), PE ratio, PB ratio, PEG Ratio. ► Future Performance Analyst estimates of Future Earnings Growth, Revenue, Cash flow, Earnings and Return on Equity. ► Past Performance EPS growth, Return on Equity (ROE), Return on Capital Employed (ROCE) and Return on Assets (ROA) over the past 5 financial years. ► Financial Health Analysis of a company's Balance Sheet, in particular the amount of debt held by the company. (Note: we use a different financial health analysis for Banks and Financial Institutions.) ► Income (dividends) Dividend payment in terms of its absolute level and against other dividend payers. In addition, the app analyses the volatility and sustainability of the dividend. ► Management Recent "insider trading” ie The Board and Management share purchases, consistency of CEO compensation with company performance and management tenure. 🌍 Markets covered 🌍 NORTH AMERICA United States(NYSE, NASDAQ & OTC) Canada (TSX, TSXV & CSE) OCEANIA Australia (ASX) New Zealand (NZX) ASIA Hong Kong (HKG) Singapore (SGX) India (NSE & BSE) EUROPE Austria (VIE) Belgium (EBR) Switzerland (SWX & BRSE) Germany (FRA, ETR, BST & MUN) Denmark (CPH) Spain (BME) Finland (HLSE) France (EPA) Greece (ATSE) Hungary (BUSE) Ireland (ISE) Italy (BIT) Luxembourg (BDL) Netherlands (AMS) Norway (OB) Poland (WSE) Portugal (ELI) Russia (MCX) Sweden (STO)

——Uploaded by the user